Education Savings: 529 Plans or Coverdell Education Savings?

There are many different options when it comes to saving for their children’s educations. There are UTMAs, savings bonds, Roth IRAs, Coverdell Education Savings Accounts (ESAs) and 529 Plans, just to name a few. Each savings strategy can be different depending on how money will be used, the income of the parents, the future cost of education and when the funds are needed.

The tax law passed in December 2017 made some meaningful changes to 529 Plans. In the past, 529 Plans were very restrictive in how funds could be utilized. Therefore, we normally recommended those who were eligible, should first contribute to a Coverdell ESA. However, the new tax law removed many of those restrictions making the 529 Plan a more favorable alternative.

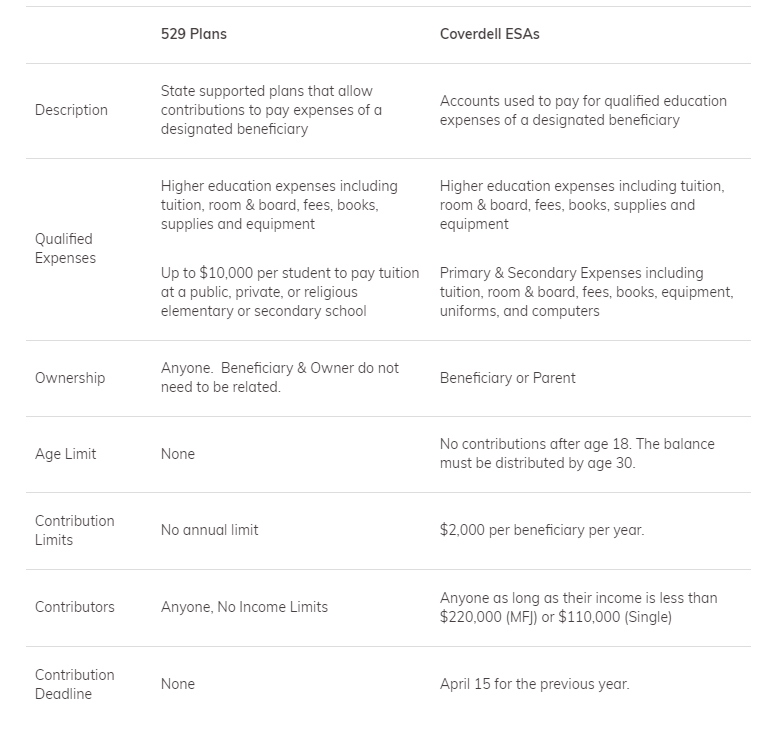

The table below summarizes many of the differences between 529 Plans and Coverdell Education Savings Accounts.

529 Plans have now been expanded to include more qualified expenses as well as primary and secondary school expenses. Once you couple that with no contribution limits or income limits, it seems that 529 Plans are the best option for most.